Key to Excellent Financial Planning is Early Investing

Today's article is my favorite , Today we will see that what is the biggest secret of Generating Long term Wealth . Most of the people run after choosing great Mutual fund and choosing right policy , but they do not understand the most important element of Investment Planning , which is Early Investing . In this article we will discuss how important is Early Investing , We will see that what you contribute early in your Life is what matters the most .

I did some Excel calculations and found out some important Rules you should remember . All the Examples in this articles assumes 12% or 15% CAGR annual return over long term (30+ yrs) . Lets see some Important Ideas you should keep in Mind .

If you are reading this article in Email , you wont see important charts and graphs , make sure you visit the blog for this particular post . thanks

The amount you invest does not increase drastically when you cut your Tenure by huge Margin .

What I mean to say here is that if you have a goal of generating a fixed amount at the end of a long period like 30 yrs and If there are two cases

Case 1 : You invest amount A per month for 10 yrs and then let it grow for next 20 yrs .

Case 2 : You invest amount B per month for all 30 years .

In this case amount A will be too big compared to amount B . It would definitely be more , not by great extent . Lets take an example . If you want to generate a corpus of 2 crores in 30 yrs and you assume a return of 12% annually . You need to invest Rs 5666 per month to achieve this target if you can invest for whole 30 yrs . But what if you want to invest only for 20 yrs or 15 yrs ? In that case how much money you need to invest per month ? The answer is Rs 6065 (20 yrs) and Rs 6611 (15 yrs) . So you can see that the monthly contribution required to meet the same goal does not increase drastically even if you reduce the tenure by 10 or 15 yrs . See the chart below

The Tenure and amount required are :

30 yrs : 5666

25 yrs : 5801

20 yrs : 6065

15 yrs : 6611

10 yrs : 7903

In the above chart you can see how "Monthly Contribution Required" increase at very small amount if you want to save the investing years later in your Life . Download this Monthly Contribution Calculator to calculate how much you need to invest monthly for your Financial Goals.

Even if you cut your Contribution at the end of the Tenure , It wont affect the final Corpus Drastically .

What this means is that If you want to invest for long term and in case you are not able to invest for many years at the end , the final amount generated will not be drastically less .. The difference will not be worth a concern .

Lets see an example , If you want to invest Rs 4000 per month for next 30 yrs and you assume 15% annual CAGR return , you would be able to generate a corpus would be 2.8 crores , But in case you just invest for 20 yrs and don't invest for rest 10 yrs , in that case your corpus will still be 2.69 crores , 96% of the original amount . If you invest for 10 yrs and don't do anything for 20 yrs , still you will be left with 2.19 crores . You can see that how your corpus is not getting affected a lot because of laziness in investing . If you are successful in early investing , your 90% job is done , even if you are not able to invest money in later years , your final amount will not be affected a lot . See the chart Below .

If you see the chart above , you can clearly see that in the first 15 yrs , the total corpus at the end does not decrease with great rate . Its more than 2 crores even if you miss 22 yrs (thats more than 70% of total tenure) .

Investments Done in Initial years are the main chunk of your Final Corpus

What this means is that what you in the start has major chunk in your final corpus , the money you invest at the end generally has no major contribution because the money compounding has done its work on the money you invested in the start , not end . See the chart below .

The time frame of this example is 30 yrs investment with assumption of 12% annual CAGR return . You can see two kind of lines here . Blue Line shows contribution of a particular year in the final corpus and Red line shows cumulative share of years till then in the final corpus . If you see the chart and concentrate on 6th yr, you will realise that what ever you invested till 6th yrs contributes to 52% share of your Final corpus which means that if you stop at 6th year , you will still be able to make 52% of original amount .

You can also see that last 12 yrs contribution helps in 10% of final corpus, this we saw in the first chart itself . So at the end , lets see some numerical facts which will help us understand power of early investing .

"Investing 1500 per month for 10 yrs and letting it grow for next 20 yrs" will generate more than "Investing 1000 per month for 30 yrs" @12% return .

"If your Original time frame was 30 yrs and later you want to cut your Tenure by 50% , you corpus will decrease just by 14%" @12% return .

A : "Investing 5000 per month for 30 yrs" B : "Investing 6,000 per month for 15 yrs and do nothing for next 15 yrs" C : "Investing 11,000 per month for just 5 yrs and do nothing for next 25 yrs" Here , C will make 1.95 crores <>

If you are a young person below 25 and you have 35 yrs in your hand and want to make 5 crores , If you start right now , you will have to invest just Rs 3,400 per month , But if you are later by 10 yrs , then you will have to invest more than 15,000 per month to achieve same target .

Conclusion

Start Early , The secret of Sound Financial Planning is Early Investing , not making excellent return or choosing great funds or buying multibagger stocks . If you can take little pain and invest more money now , then better do it , It will save you from lot of trouble later .

Thursday, September 17, 2009

Friday, September 11, 2009

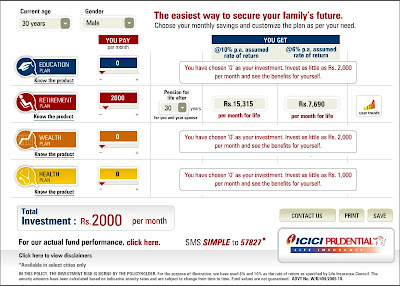

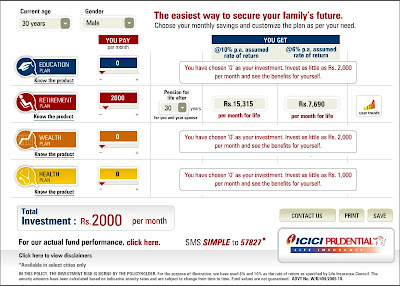

Retirement Plan - ICICI Pru LifeStage Assure Pension

Nowadays so many peoples are worried about which Retirement Plans to take.

Here is a perfect example of financial companies taking investors for a grand ride.

Go to simpleinsurance.co.in for a chart of various investment/ insurance options from ICICI Prudential Life Insurance.

For example, consider the Retirement Plan (ICICI Pru LifeStage Assure Pension) by ICICI. For a 30 year old male, with an investment of Rs.2000 per month for 30 years, the plan with an optimistic 10% per annum growth rate will give a pension of Rs.15,315 per month for life from the 31st year onwards.

But are these plans good investment options?

Now here is the catch. All of these plans are unit linked. Any unit linked plan is confusing - with a variety a charges (asset allocation charge, fund management charge, mortality charge, etc.) deducted differently (either in terms units or deducting directly from the investment) at different times (at the beginning of the investment, monthly or yearly) and unpredictable growth rates (which are limited by the IRDA to 6% and 10% for illustration purposes). So each of these plans need to be evaluated in terms of their overall attractiveness.

How can these plans be evaluated?

The best way to evaluate investment/insurance plans is by separating the insurance (if bundled) and investment components. Compare the investment returns with that of a fixed deposit after adjusting best available rates for the bundled insurance (if any).

The Rs.15,315 pension per month for ICICI Pru Life Stage Assure Pension Plan looks impressive on a cursory glance, especially for an outlay of just Rs.2,000 per month.

Every thing is said in numbers – Agents will tell you that you have to pay only Rs 2000 /- per month for only 30 years and then you will receive Rs 15,315 per month for whole life. So at first glance this scheme looks awesome. Isn't it !!!

But let's have a closer look. Let us put the Rs.2,000 per month in a bank fixed deposit (FD) at a nominal 8% interest compounded annually. That makes Rs.24,000 annual investment in FD. For the next 30 years, let us assume that the interest rate remains constant at 8%. The Rs.24,000 per annum investment at 8% will accumulate to Rs.29.36 lakhs. You can even go with PPF account that also gives 8% tax-free returns. No need to say that PPF (Government of India) are the safest product in India. Even Supreme Court cannot attach any litigation to your PPF account as per constitution.

This amount (Rs.29.36 lakhs) if reinvested again after 30 years in FD at 8% interest will give annual interest of Rs.2.35 lakhs or a monthly interest of Rs.19,575 for life. Now compare this with the Rs.15,315 per month ICICI's Retirement Plan. The FD comprehensively beats the returns of ICICI by a massive Rs.4,260 per month (21.8% more). And don't forget that the FD or PPF return is more or less guaranteed where as ICICI's 10% return in risky and market dependent (it could be less, or more). Also, the accumulated Rs.29.36 lakhs is preserved for passing on to the next generation.

Means the monthly pension of Rs 19,575 is not only for you but also for your many-many generations to come. As it is coming from bank fixed deposit and not from some rubbish plan.

The case becomes even more compelling if we consider an SIP investment of Rs.2000 in a well-diversified large cap mutual fund for 30 years (which can give returns in excess of 10% per annum) and then putting the cumulative amount in an FD to draw pension for life at 8% per annum!

Mutual Fund Example:

If one invest 24,000 yearly (Rs 2000 monthly) at 10% per annum for 30 years.

Accumulated sum will be Rs 43,42,642 [ 43+ lacs ]

This amount if you keep in FD at 8% which will give you yearly return of Rs 3,47,411

Means you can withdraw monthly pension of Rs 28,950 /- [ 89% more that ICICI ]

Now compare this with ICICI’s pension amount of Rs 15,315

If you see the television add that ICICI Insurance company is showing you will think they are giving you double amount: Click here

So what's the verdict?

Isn't it obvious? In the above example a simple FD or a PPF (or mutual fund) would work much better than the pension plan by ICICI. The situation is not very different for the other plans either.

Investors need to be extremely cautious while selecting investment options. Insurance companies trick the investor emotions with children plans and retirement plans and misleading returns. They have devised clever ways to disguise costs and still work within the regulatory framework to (mis) sell insurance products. Deviating from their fundamental purpose (and duty) of selling insurance, most of these companies (including nationalized ones) have aggressively marketed and promoted bundled and complicated products. The profit sucked out of the investor's money goes as profit to the insurance company and as hefty commissions to insurance agents.

Conclusion

Never ever buy Retirement Plans / Children Plan / ULIP’s from such companies. Do you own calculations before buying any insurance plan. If you cannot do the calculation, mail me I will do it for you for FREE.

Here is a perfect example of financial companies taking investors for a grand ride.

Go to simpleinsurance.co.in for a chart of various investment/ insurance options from ICICI Prudential Life Insurance.

For example, consider the Retirement Plan (ICICI Pru LifeStage Assure Pension) by ICICI. For a 30 year old male, with an investment of Rs.2000 per month for 30 years, the plan with an optimistic 10% per annum growth rate will give a pension of Rs.15,315 per month for life from the 31st year onwards.

But are these plans good investment options?

Now here is the catch. All of these plans are unit linked. Any unit linked plan is confusing - with a variety a charges (asset allocation charge, fund management charge, mortality charge, etc.) deducted differently (either in terms units or deducting directly from the investment) at different times (at the beginning of the investment, monthly or yearly) and unpredictable growth rates (which are limited by the IRDA to 6% and 10% for illustration purposes). So each of these plans need to be evaluated in terms of their overall attractiveness.

How can these plans be evaluated?

The best way to evaluate investment/insurance plans is by separating the insurance (if bundled) and investment components. Compare the investment returns with that of a fixed deposit after adjusting best available rates for the bundled insurance (if any).

The Rs.15,315 pension per month for ICICI Pru Life Stage Assure Pension Plan looks impressive on a cursory glance, especially for an outlay of just Rs.2,000 per month.

Every thing is said in numbers – Agents will tell you that you have to pay only Rs 2000 /- per month for only 30 years and then you will receive Rs 15,315 per month for whole life. So at first glance this scheme looks awesome. Isn't it !!!

But let's have a closer look. Let us put the Rs.2,000 per month in a bank fixed deposit (FD) at a nominal 8% interest compounded annually. That makes Rs.24,000 annual investment in FD. For the next 30 years, let us assume that the interest rate remains constant at 8%. The Rs.24,000 per annum investment at 8% will accumulate to Rs.29.36 lakhs. You can even go with PPF account that also gives 8% tax-free returns. No need to say that PPF (Government of India) are the safest product in India. Even Supreme Court cannot attach any litigation to your PPF account as per constitution.

This amount (Rs.29.36 lakhs) if reinvested again after 30 years in FD at 8% interest will give annual interest of Rs.2.35 lakhs or a monthly interest of Rs.19,575 for life. Now compare this with the Rs.15,315 per month ICICI's Retirement Plan. The FD comprehensively beats the returns of ICICI by a massive Rs.4,260 per month (21.8% more). And don't forget that the FD or PPF return is more or less guaranteed where as ICICI's 10% return in risky and market dependent (it could be less, or more). Also, the accumulated Rs.29.36 lakhs is preserved for passing on to the next generation.

Means the monthly pension of Rs 19,575 is not only for you but also for your many-many generations to come. As it is coming from bank fixed deposit and not from some rubbish plan.

The case becomes even more compelling if we consider an SIP investment of Rs.2000 in a well-diversified large cap mutual fund for 30 years (which can give returns in excess of 10% per annum) and then putting the cumulative amount in an FD to draw pension for life at 8% per annum!

Mutual Fund Example:

If one invest 24,000 yearly (Rs 2000 monthly) at 10% per annum for 30 years.

Accumulated sum will be Rs 43,42,642 [ 43+ lacs ]

This amount if you keep in FD at 8% which will give you yearly return of Rs 3,47,411

Means you can withdraw monthly pension of Rs 28,950 /- [ 89% more that ICICI ]

Now compare this with ICICI’s pension amount of Rs 15,315

If you see the television add that ICICI Insurance company is showing you will think they are giving you double amount: Click here

So what's the verdict?

Isn't it obvious? In the above example a simple FD or a PPF (or mutual fund) would work much better than the pension plan by ICICI. The situation is not very different for the other plans either.

Investors need to be extremely cautious while selecting investment options. Insurance companies trick the investor emotions with children plans and retirement plans and misleading returns. They have devised clever ways to disguise costs and still work within the regulatory framework to (mis) sell insurance products. Deviating from their fundamental purpose (and duty) of selling insurance, most of these companies (including nationalized ones) have aggressively marketed and promoted bundled and complicated products. The profit sucked out of the investor's money goes as profit to the insurance company and as hefty commissions to insurance agents.

Conclusion

Never ever buy Retirement Plans / Children Plan / ULIP’s from such companies. Do you own calculations before buying any insurance plan. If you cannot do the calculation, mail me I will do it for you for FREE.

Thursday, September 3, 2009

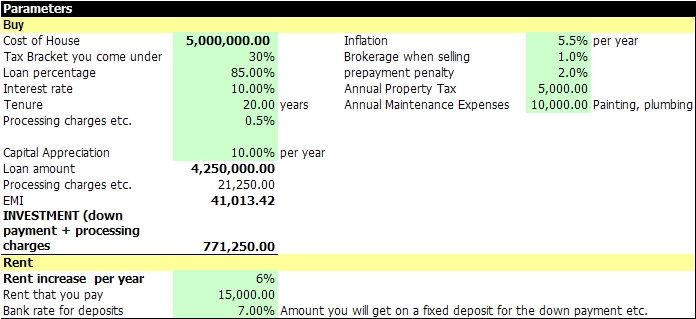

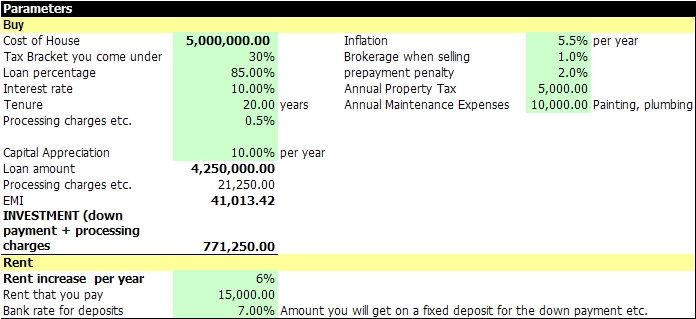

Should I stay in a rented house or buy one ?

Another excellent article from Deepak Shenoy on "Should I rent a house or buy one ?"

The article has a link to get the excel sheet to calculate the difference between rented and self house w/ accrued gain/loss .

But I am attaching that excel sheet for your ready use.

Click here for Direct Link

The question one often asks when one gets to a comfortable state of personal affairs is: Should I rent a house or buy one?

All your friends are buying houses, or at least have "booked" them. There are good sentimental reasons to do so - owning a house ensures a tiny element of piece of mind - you can change things you don't like, like the drawers in your kitchen cabinet, or the paint on the walls, or add wooden flooring or a bathtub and such. But does it make financial sense to do this?

There are some advantages of each, but I shall take the Indian perspective. Here's where we are with Renting:

* Renting in India typically costs less than 3% of a house value. Meaning, if a house's market value is Rs. 50 lakhs, the rental will be around Rs. 15,000 per month.

* Tax breaks are available: Around 40% of your basic salary (or the rent, whichever is lower) is deductible from your taxable income.

But there are tax advantages for buying too. Here's where we are:

* Payments on Interest upto Rs. 150,000 per year is tax deductible.

* Principal repayments are tax free upto Rs. 100,000 per year. (Section 80C)

Let's see the comparison for a Rs. 50 Lakh house. I'm assuming that if you were to buy this house you will have a certain amount as "down payment" and pay a much higher EMI per month than the corresponding rent (Rs. 41,000 EMI, vs. Rs. 15,000 rent). If you rented, the extra money goes into the bank as a saving, and so does the down payment.

The return analysis on this, is in an excel sheet I have built, but here's the summary:

Key points to note:

* Cash flow wise, Renting is better for the first 8 years.

* After 8 years, buying is better, and after twenty years, the bought house is better by Rs. 1.4 crores!

* The equation is skewed to some extent because of the limits on the tax saving. The limit of Rs. 150,000 on the interest is too low - for the first 15 years, you pay more than 150,000 interest per year.

* Even the principal paid is more than 100,000 per year, so the tax saving there is limited too.

(Download the real estate calculator excel sheet)

If you're in for the long term you should buy, but remember this: If you think the prices will stabilize or come down in the next eight years, delay your decision to buy. After all, renting is far more cheaper and you will have much more money saved up in the longer term.

Also, be more aggressive in your investments to give you a better return, and therefore a better down payment.

Finally, remember that owning your house is important for sentimental and personal reasons too. The happiness you can derive from having an own house perhaps outweighs financial reasons.

The article has a link to get the excel sheet to calculate the difference between rented and self house w/ accrued gain/loss .

But I am attaching that excel sheet for your ready use.

Click here for Direct Link

The question one often asks when one gets to a comfortable state of personal affairs is: Should I rent a house or buy one?

All your friends are buying houses, or at least have "booked" them. There are good sentimental reasons to do so - owning a house ensures a tiny element of piece of mind - you can change things you don't like, like the drawers in your kitchen cabinet, or the paint on the walls, or add wooden flooring or a bathtub and such. But does it make financial sense to do this?

There are some advantages of each, but I shall take the Indian perspective. Here's where we are with Renting:

* Renting in India typically costs less than 3% of a house value. Meaning, if a house's market value is Rs. 50 lakhs, the rental will be around Rs. 15,000 per month.

* Tax breaks are available: Around 40% of your basic salary (or the rent, whichever is lower) is deductible from your taxable income.

But there are tax advantages for buying too. Here's where we are:

* Payments on Interest upto Rs. 150,000 per year is tax deductible.

* Principal repayments are tax free upto Rs. 100,000 per year. (Section 80C)

Let's see the comparison for a Rs. 50 Lakh house. I'm assuming that if you were to buy this house you will have a certain amount as "down payment" and pay a much higher EMI per month than the corresponding rent (Rs. 41,000 EMI, vs. Rs. 15,000 rent). If you rented, the extra money goes into the bank as a saving, and so does the down payment.

The return analysis on this, is in an excel sheet I have built, but here's the summary:

Key points to note:

* Cash flow wise, Renting is better for the first 8 years.

* After 8 years, buying is better, and after twenty years, the bought house is better by Rs. 1.4 crores!

* The equation is skewed to some extent because of the limits on the tax saving. The limit of Rs. 150,000 on the interest is too low - for the first 15 years, you pay more than 150,000 interest per year.

* Even the principal paid is more than 100,000 per year, so the tax saving there is limited too.

(Download the real estate calculator excel sheet)

If you're in for the long term you should buy, but remember this: If you think the prices will stabilize or come down in the next eight years, delay your decision to buy. After all, renting is far more cheaper and you will have much more money saved up in the longer term.

Also, be more aggressive in your investments to give you a better return, and therefore a better down payment.

Finally, remember that owning your house is important for sentimental and personal reasons too. The happiness you can derive from having an own house perhaps outweighs financial reasons.

Tuesday, September 1, 2009

Jeevan Tarang Policy from LIC

We will discuss about LIC's Jeevan Tarang Policy today and lets evaluate and answer the question "Is Jeevan Tarang worth consideration or Not" ?

Also see how can we beat this Policy by huge margin .

Jeevan Tarang Policy Highlights

* Jeevan Tarang is a Whole Life Plan from LIC , Whole life plan means that you are insured for whole life (max age 100) The plan offers three Accumulation periods – 10, 15 and 20 years. A proposer may choose any of them. This is the Tenure by when your Policy Matures.

* Whenever you die , you will get the Sum assured and then the Policy Expires . This policy will expire if you are at age 100 .

* If you Die before the Maturity , you will get the Sum Assured + All the Bonus Accumulated till date .

* The yearly Premium will depends on two things , your Tenure and your Age . It can range from 11% (Policy for 10 yrs) , 7-8% (Policy for 15 yrs) or 5-5.5% (policy for 20 yrs) .

For exact numbers see here. The percentages are with respect to your Sum Assured , 5.5% premium means 5.5% of your Sum assured . so Rs 10,00,000 of Sum assured means 55,000 of Premium each Year .

* Incase you survive till your Policy Tenure , then at the end of your Tenure , you will get Bonus accumulated (not the Sum assured) and an annuity of exact 5.5% each year after the Policy Matures . One will get 5.5% of the Sum Assured each year till his death or upto age 100 whichever is earlier .

* If you can not pay the Premiums and want to stop the policy (only after 3 yrs) , you have two choices , either make it a Paidup policy or take back the Surrender Value . This is explained in detail later , so move on .

* These are the main basic and approximate points of the Policy , for exact details see the policy page at LIC website .

Let us now see an example with different Scenario .This will help you understand it better.

Now let take Scenario's

Ajay's age is 30 and he takes Jeevan Tarang Policy for a tenure for 15 yrs with Sum Assured of Rs 10,00,000 (10 Lacs) . His Yearly Premiums will be 71.40 for every 1000 sum assured , which is 7.14% . Which comes to 71,400 per year .

If Ajay dies before 15 yrs

In this case he will get Sum Assured + Bonus Accumulated till date. The Bonus amount is not fixed and we can not tell how much it will be now , But on LIC webpage its mentioned in range of Rs 20-88 . Lets take a good figure of Rs 30 . In that case Per year it would be 30,000 more . So If he dies in 8th year , it would be 10 lacs (Sum Assured) + 2.4 lacs (bonus for 8 yrs) = 12.4 Lacs and the policy Expires .

If Ajay survives the Policy and does not die at all

In this case , Ajay will pay his premium upto 15 years and then in 15th year , he will get back the Bonus accumulated (not sum assured) , so may be it would be 4.5-5 lacs assuming Rs 30 as Bonus for every 1000 SA . Also he will get 55,000 per year(remember 5.5% of Sum Assured) as annuity till he dies or upto age 100 . He will also get Loyalty additions , this will again be a very small amount just like Bonus , but this is not assured at all .

If Ajay survives the Policy and Dies Later .

Its almost the same case as above , in this , Ajay will get Bonus at the end of 15 yrs and then He will start receiving 55,000 ever year . And suppose he dies before age 100 , he will receive the Sum Assured of Rs 10 lacs and that's it. The game is over and then LIC doesn't recognize him there after .

Ajay is not able to pay premiums because of some problem and wants to stop .

This is possible only after 3 yrs of taking the Policy , If he wants to stop it before 3 yrs , then sorry buddy , just forget your Money and go home cry . If its after 3 yrs , then He has two choices

* Make the Policy Paid up : In this case , you stop the Premium payments and you will get your Premiums and Bonus Accumulated will date at the end of the Maturity . You Sum assured will also reduce in Proportion to Premiums Paid, so if you stop the policy in 6th year , your Sum assured will reduce from 10 lacs to 4 lacs (40%) , as you have paid the premium only for 40% of the tenure (15 yrs) , that's 6 yrs .

* Take your Money Back : After 3 yrs of completion , the Policy acquires a Surrender value , generally its the Net Present Value of money in today's term what you are going to get at the end . See this post on Net Asset Value . So if you are going to get 5 lacs at the end of 15 yrs and today's worth of that money is 2 lacs , you will get 2 lacs today .

What is the Return of Jeevan Tarang Policy overall ?

Even if you receive all the annuity upto your age of 100 , the CAGR return for this policy using IRR Analysis comes to mere 4.72% . I have taken the above example and assumed 5 lacs of Bonus and no loyalty additions , even if we consider 7-8 lacs of Bonus and Some loyalty additions, the CAGR return does not cross 6% CAGR .

Why this Policy excites people and general people get fooled ?

These kind of Endowment policies make sure that you concentrate too much on numbers and it traps your mindset in the present moment , One who is able to foresee beyond "now" can understand the real value of these Policies .

We concentrate on numbers, If we get something for a long time and we pay for less time , it appeals to us , and hence this policy takes care of that very beautifully , You pay for 10 , 15 or 20 yrs and you get back till you are Age 100 , Sounds great !! .

Psychologically our mind is programmed by nature to think about the best case for our self , but how many of us will survive upto 100 yrs to get annuity back, The average person thinks emotionally , Insurance Companies work on Data , Statistics , Probability Theory and Complex calculations , which tell them that average person will die at 60-70 , and only 1-2 will survive till 100 years of their age .

Most of the people see Numbers and Present , The policy will demonstrate how much You will get at the end of the Maturity but it never tells you how much will it be worth then and how much will it help you in your Financial goals . We never think that Rs 100 today can buy much more than Rs 100 after 15 or 30 yrs . We know this somewhere inside us , but out mind just doesn't feel every time the same way , that's the reason you need to calculate things by hand , on paper or computer and do some small analysis like I did on this article . Then you get the clarity

Trust and Blind Faith , We trust companies because they have been in existence from long time and our parents were made to believe that these are the best friends in our life , they will protect our Future . Love and "Taking Endowment Policies" in India has similarity . I grew up hearing Love is Blind and experienced it too , and I feel that its same with Taking Endowment Polices . People just take it blindly , some new Policy comes up and bang !! , it has to be great , no matter what , because it comes from the GOD's own company !! . No one will concentrate on 4 important features of his portfolio and how that policy fits in.

What are the Limitations of the Policy

* Why age 100 ? How many people are going to live upto age 100 , why putting that number at 100 , why not increase it to 500 , even though life expectancy is just 60-70 . Not more than 1-2 in 100 live upto 100 .

* In case of Ajay , if his monthly expenses is 30,000 (considering married ,even though I doubt he will ever get any one) , after the accumulation period of 15 yrs , he will start receiving yearly pension of 55,000 per year , read it again , 55,000 per year , but now after 15 yrs , even with 6% of inflation his monthly expenses has gone upto 72,000 . And his policy pays him 55,000 which cannot even take care of his 1 month of expenses . Now i can see him pulling all his hairs .

* If he is dead at age 70 , His family would get back the Sum assured of 10 lacs and at that time , it can only pay for his family's 3-4 months of expenses and his Funeral cost , that's it .. Aha .. atleast something , so one this is confirmed , There will be no financial burden , pun intended .

Can we do better ?

This is the question which we should always ask in every situation of our life , not just Financial planning . Lets take care of Ajay's situation and plan him something better than Jeevan Tarang .

With Rs 71,600 per year to pay for 15 yrs , lets see what can we do .

First thing First , Lets cover his Family first from the Mishappenings of life an secure his dependents , Lets take a Term Insurance of 50 lacs for maximum tenure of 30 yrs , Premium would be close to 13k or 14k approx , lets assume 14k . So out of 71,600 , 14k is gone and we are left with 57,600 .

Now lets put 21,600 each year in PPF for 15 yrs . We are now left with 36,000 to invest , we will start Rs 3,000 SIP per month (Rs 1000 each in 3 different Equity funds) for 15 yrs .

PPF will accumulate to 6.3 lacs in 15 yrs and Mutual funds will accumulate to 15 lacs in 15 yrs assuming a pessimistic return of just 12% (Historical return has been more than 17% and last 5 yrs return are more than 25%) . Lets assume just 12% and not 18-20% even though its possible because our aim is to do better than Jeevan Tarang and achieve our goals and not compete with some one . So total amount will be around 21.3 lacs at the end of 15 yrs . Now lets visit and see our Scenario's again and hows does it compare now .

If Ajay dies before 15 yrs : Gets 50 lacs from Term Insurance and also the money from PPF and mutual funds , which will be more than 50 lacs :) . We beat Jeevan Tarang by huge margin in this case .

If Ajay survives and Does not Die at all : In this case he already has 21.3 lacs accumulated and now he can use this amount to buy an Annuity which will pay him more than 1.6 lacs Per year , much more than what he was getting in LIC policy . As a toppings , he also has a 50 lac cover for another 15 years . We can generate 3 times more annuity than Jeevan Astha here , again beat by huge margin .

If Ajay survives the Policy and Dies Later : In this case if he dies in next 15 yrs , his family would get 50 lacs from Insurance (10 lacs in LIC - Jeevan Tarang) , apart from this he will have his 21.3 lacs growing every year . If he dies after 15 more year , There will be no Insurance money , but his money would have grown a lot by now .. If he dies after 15 yrs (total 30 yrs from starting) , his money would have grown to 1.17 crores assuming 12% return per year (no annuity every year) . and if he dies after 25 years (total 40 yrs from starting , means at age 70) , his money would have grown to 6 crores . Now incase you don't want to faint , don't ask me how much would have he had if he lived till age 100 and left his money to grow , Its 13 crores :) . I have not assumed any annual annuity here , we can do that but the result would remain almost same . We beat Jeevan Tarang by hugest margin in this case .

Ajay is not able to pay premiums because of some problem and wants to stop .

His money will still be in PPF and Mutual funds and keep growing , there is no liquidity issue with Mutual funds , he can withdraw from mutual funds anytime ,even from PPF he can withdraw partially . If he has limited money , he can atleast pay his Insurance premiums and still get covered for 50 lacs , no big deal there . In every aspect it beats Jeevan Tarang

Note : For doing better than Jeevan Tarang we have invested in Mutual funds which are risky instruments , but anyways we are not in great position with Jeevan Tarang . so taking risk is worth it . If one is too concerned about risk , then even plain PPF will be better .

Conclusion : Think Logical , Think mathematical , Think smartly and atlast THINK !! .

Note : The figures have not considered the rebate provided by LIC , and hence the actual figures can deviate a bit from the actual numbers used here , but it wont be significant and the review still holds . ahh .. tired now !!

Also see how can we beat this Policy by huge margin .

Jeevan Tarang Policy Highlights

* Jeevan Tarang is a Whole Life Plan from LIC , Whole life plan means that you are insured for whole life (max age 100) The plan offers three Accumulation periods – 10, 15 and 20 years. A proposer may choose any of them. This is the Tenure by when your Policy Matures.

* Whenever you die , you will get the Sum assured and then the Policy Expires . This policy will expire if you are at age 100 .

* If you Die before the Maturity , you will get the Sum Assured + All the Bonus Accumulated till date .

* The yearly Premium will depends on two things , your Tenure and your Age . It can range from 11% (Policy for 10 yrs) , 7-8% (Policy for 15 yrs) or 5-5.5% (policy for 20 yrs) .

For exact numbers see here. The percentages are with respect to your Sum Assured , 5.5% premium means 5.5% of your Sum assured . so Rs 10,00,000 of Sum assured means 55,000 of Premium each Year .

* Incase you survive till your Policy Tenure , then at the end of your Tenure , you will get Bonus accumulated (not the Sum assured) and an annuity of exact 5.5% each year after the Policy Matures . One will get 5.5% of the Sum Assured each year till his death or upto age 100 whichever is earlier .

* If you can not pay the Premiums and want to stop the policy (only after 3 yrs) , you have two choices , either make it a Paidup policy or take back the Surrender Value . This is explained in detail later , so move on .

* These are the main basic and approximate points of the Policy , for exact details see the policy page at LIC website .

Let us now see an example with different Scenario .This will help you understand it better.

Now let take Scenario's

Ajay's age is 30 and he takes Jeevan Tarang Policy for a tenure for 15 yrs with Sum Assured of Rs 10,00,000 (10 Lacs) . His Yearly Premiums will be 71.40 for every 1000 sum assured , which is 7.14% . Which comes to 71,400 per year .

If Ajay dies before 15 yrs

In this case he will get Sum Assured + Bonus Accumulated till date. The Bonus amount is not fixed and we can not tell how much it will be now , But on LIC webpage its mentioned in range of Rs 20-88 . Lets take a good figure of Rs 30 . In that case Per year it would be 30,000 more . So If he dies in 8th year , it would be 10 lacs (Sum Assured) + 2.4 lacs (bonus for 8 yrs) = 12.4 Lacs and the policy Expires .

If Ajay survives the Policy and does not die at all

In this case , Ajay will pay his premium upto 15 years and then in 15th year , he will get back the Bonus accumulated (not sum assured) , so may be it would be 4.5-5 lacs assuming Rs 30 as Bonus for every 1000 SA . Also he will get 55,000 per year(remember 5.5% of Sum Assured) as annuity till he dies or upto age 100 . He will also get Loyalty additions , this will again be a very small amount just like Bonus , but this is not assured at all .

If Ajay survives the Policy and Dies Later .

Its almost the same case as above , in this , Ajay will get Bonus at the end of 15 yrs and then He will start receiving 55,000 ever year . And suppose he dies before age 100 , he will receive the Sum Assured of Rs 10 lacs and that's it. The game is over and then LIC doesn't recognize him there after .

Ajay is not able to pay premiums because of some problem and wants to stop .

This is possible only after 3 yrs of taking the Policy , If he wants to stop it before 3 yrs , then sorry buddy , just forget your Money and go home cry . If its after 3 yrs , then He has two choices

* Make the Policy Paid up : In this case , you stop the Premium payments and you will get your Premiums and Bonus Accumulated will date at the end of the Maturity . You Sum assured will also reduce in Proportion to Premiums Paid, so if you stop the policy in 6th year , your Sum assured will reduce from 10 lacs to 4 lacs (40%) , as you have paid the premium only for 40% of the tenure (15 yrs) , that's 6 yrs .

* Take your Money Back : After 3 yrs of completion , the Policy acquires a Surrender value , generally its the Net Present Value of money in today's term what you are going to get at the end . See this post on Net Asset Value . So if you are going to get 5 lacs at the end of 15 yrs and today's worth of that money is 2 lacs , you will get 2 lacs today .

What is the Return of Jeevan Tarang Policy overall ?

Even if you receive all the annuity upto your age of 100 , the CAGR return for this policy using IRR Analysis comes to mere 4.72% . I have taken the above example and assumed 5 lacs of Bonus and no loyalty additions , even if we consider 7-8 lacs of Bonus and Some loyalty additions, the CAGR return does not cross 6% CAGR .

Why this Policy excites people and general people get fooled ?

These kind of Endowment policies make sure that you concentrate too much on numbers and it traps your mindset in the present moment , One who is able to foresee beyond "now" can understand the real value of these Policies .

We concentrate on numbers, If we get something for a long time and we pay for less time , it appeals to us , and hence this policy takes care of that very beautifully , You pay for 10 , 15 or 20 yrs and you get back till you are Age 100 , Sounds great !! .

Psychologically our mind is programmed by nature to think about the best case for our self , but how many of us will survive upto 100 yrs to get annuity back, The average person thinks emotionally , Insurance Companies work on Data , Statistics , Probability Theory and Complex calculations , which tell them that average person will die at 60-70 , and only 1-2 will survive till 100 years of their age .

Most of the people see Numbers and Present , The policy will demonstrate how much You will get at the end of the Maturity but it never tells you how much will it be worth then and how much will it help you in your Financial goals . We never think that Rs 100 today can buy much more than Rs 100 after 15 or 30 yrs . We know this somewhere inside us , but out mind just doesn't feel every time the same way , that's the reason you need to calculate things by hand , on paper or computer and do some small analysis like I did on this article . Then you get the clarity

Trust and Blind Faith , We trust companies because they have been in existence from long time and our parents were made to believe that these are the best friends in our life , they will protect our Future . Love and "Taking Endowment Policies" in India has similarity . I grew up hearing Love is Blind and experienced it too , and I feel that its same with Taking Endowment Polices . People just take it blindly , some new Policy comes up and bang !! , it has to be great , no matter what , because it comes from the GOD's own company !! . No one will concentrate on 4 important features of his portfolio and how that policy fits in.

What are the Limitations of the Policy

* Why age 100 ? How many people are going to live upto age 100 , why putting that number at 100 , why not increase it to 500 , even though life expectancy is just 60-70 . Not more than 1-2 in 100 live upto 100 .

* In case of Ajay , if his monthly expenses is 30,000 (considering married ,even though I doubt he will ever get any one) , after the accumulation period of 15 yrs , he will start receiving yearly pension of 55,000 per year , read it again , 55,000 per year , but now after 15 yrs , even with 6% of inflation his monthly expenses has gone upto 72,000 . And his policy pays him 55,000 which cannot even take care of his 1 month of expenses . Now i can see him pulling all his hairs .

* If he is dead at age 70 , His family would get back the Sum assured of 10 lacs and at that time , it can only pay for his family's 3-4 months of expenses and his Funeral cost , that's it .. Aha .. atleast something , so one this is confirmed , There will be no financial burden , pun intended .

Can we do better ?

This is the question which we should always ask in every situation of our life , not just Financial planning . Lets take care of Ajay's situation and plan him something better than Jeevan Tarang .

With Rs 71,600 per year to pay for 15 yrs , lets see what can we do .

First thing First , Lets cover his Family first from the Mishappenings of life an secure his dependents , Lets take a Term Insurance of 50 lacs for maximum tenure of 30 yrs , Premium would be close to 13k or 14k approx , lets assume 14k . So out of 71,600 , 14k is gone and we are left with 57,600 .

Now lets put 21,600 each year in PPF for 15 yrs . We are now left with 36,000 to invest , we will start Rs 3,000 SIP per month (Rs 1000 each in 3 different Equity funds) for 15 yrs .

PPF will accumulate to 6.3 lacs in 15 yrs and Mutual funds will accumulate to 15 lacs in 15 yrs assuming a pessimistic return of just 12% (Historical return has been more than 17% and last 5 yrs return are more than 25%) . Lets assume just 12% and not 18-20% even though its possible because our aim is to do better than Jeevan Tarang and achieve our goals and not compete with some one . So total amount will be around 21.3 lacs at the end of 15 yrs . Now lets visit and see our Scenario's again and hows does it compare now .

If Ajay dies before 15 yrs : Gets 50 lacs from Term Insurance and also the money from PPF and mutual funds , which will be more than 50 lacs :) . We beat Jeevan Tarang by huge margin in this case .

If Ajay survives and Does not Die at all : In this case he already has 21.3 lacs accumulated and now he can use this amount to buy an Annuity which will pay him more than 1.6 lacs Per year , much more than what he was getting in LIC policy . As a toppings , he also has a 50 lac cover for another 15 years . We can generate 3 times more annuity than Jeevan Astha here , again beat by huge margin .

If Ajay survives the Policy and Dies Later : In this case if he dies in next 15 yrs , his family would get 50 lacs from Insurance (10 lacs in LIC - Jeevan Tarang) , apart from this he will have his 21.3 lacs growing every year . If he dies after 15 more year , There will be no Insurance money , but his money would have grown a lot by now .. If he dies after 15 yrs (total 30 yrs from starting) , his money would have grown to 1.17 crores assuming 12% return per year (no annuity every year) . and if he dies after 25 years (total 40 yrs from starting , means at age 70) , his money would have grown to 6 crores . Now incase you don't want to faint , don't ask me how much would have he had if he lived till age 100 and left his money to grow , Its 13 crores :) . I have not assumed any annual annuity here , we can do that but the result would remain almost same . We beat Jeevan Tarang by hugest margin in this case .

Ajay is not able to pay premiums because of some problem and wants to stop .

His money will still be in PPF and Mutual funds and keep growing , there is no liquidity issue with Mutual funds , he can withdraw from mutual funds anytime ,even from PPF he can withdraw partially . If he has limited money , he can atleast pay his Insurance premiums and still get covered for 50 lacs , no big deal there . In every aspect it beats Jeevan Tarang

Note : For doing better than Jeevan Tarang we have invested in Mutual funds which are risky instruments , but anyways we are not in great position with Jeevan Tarang . so taking risk is worth it . If one is too concerned about risk , then even plain PPF will be better .

Conclusion : Think Logical , Think mathematical , Think smartly and atlast THINK !! .

Note : The figures have not considered the rebate provided by LIC , and hence the actual figures can deviate a bit from the actual numbers used here , but it wont be significant and the review still holds . ahh .. tired now !!

Subscribe to:

Posts (Atom)